editorial-team@simplywallst.com (Simply Wall St)

·3-min read

Over the last 7 days, the Australian market has remained flat, though it is up 7.8% over the past year with earnings expected to grow by 13% per annum over the next few years. In this environment, identifying strong dividend stocks can be a strategic way to generate consistent income while potentially benefiting from future growth.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.52% | ★★★★★☆ |

Collins Foods (ASX:CKF) | 3.10% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.22% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.01% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.67% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.11% | ★★★★★☆ |

MFF Capital Investments (ASX:MFF) | 3.12% | ★★★★★☆ |

Auswide Bank (ASX:ABA) | 10.00% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.73% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.24% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

ADVERTIsem*nT

Here we highlight a subset of our preferred stocks from the screener.

Auswide Bank

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Auswide Bank Ltd provides a range of personal and business banking products and services in Australia, with a market cap of approximately A$200.51 million.

Operations: Auswide Bank Ltd generates revenue primarily through its retail banking segment, which accounts for A$92.13 million.

Dividend Yield: 10%

Auswide Bank's dividend payments have been volatile over the past decade, despite an overall increase. Currently, its dividends are covered by earnings with a payout ratio of 78.9%, and this coverage is expected to remain sustainable at 76.6% in three years. Trading at 48% below our fair value estimate, Auswide offers a high dividend yield in the top 25% of Australian payers but presents risks due to its unstable track record.

Australian United Investment

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited (ASX:AUI) is a publicly owned investment manager with a market cap of A$1.28 billion.

Operations: Australian United Investment Company Limited generates revenue of A$58.33 million from its investment activities.

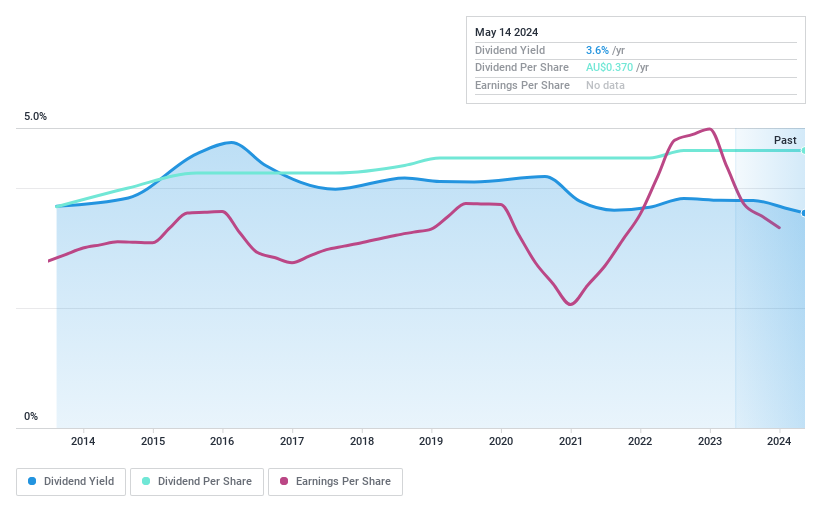

Dividend Yield: 3.6%

Australian United Investment's dividends have been stable and growing over the past decade, though the current yield of 3.57% is below top-tier Australian dividend payers. The high payout ratio of 92.4% indicates dividends are not well covered by earnings, but a cash payout ratio of 86.7% shows coverage by cash flows is adequate. Recent news includes an extension of its buyback plan until May 29, 2025, potentially impacting future dividend sustainability.

GrainCorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GrainCorp Limited is an agribusiness and processing company with operations across Australasia, Asia, North America, Europe, the Middle East, and North Africa, holding a market cap of A$1.95 billion.

Operations: GrainCorp Limited's primary revenue segment is Agribusiness, generating A$6.82 billion.

Dividend Yield: 6.1%

GrainCorp's dividend payments are covered by earnings with a payout ratio of 63.4% and well-supported by cash flows at 37.2%. Although dividends have grown over the past decade, they have been volatile and unreliable. Recent strategic alliances, including a Memorandum of Understanding with IFM Investors and Ampol to explore renewable fuels, highlight potential growth avenues but do not directly impact current dividend stability or yield, which stands at 6.11%.

Get an in-depth perspective on GrainCorp's performance by reading our dividend report here.

The valuation report we've compiled suggests that GrainCorp's current price could be inflated.

Where To Now?

Access the full spectrum of 31 Top ASX Dividend Stocks by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:ABA ASX:AUI and ASX:GNC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com